The European Union has been investing in its development as a unit of several countries, and this includes advances in its technologies and suppliers to achieve a higher strategic independence and even more active political participation on the international stage.

Economic and political relations with Russia are increasingly strained, especially with the Russian attempt to advance in Ukraine since its conquest of Crimea in 2014. However, Russia remains the largest exporter of natural gas to Europe, which gives it more freedom to coerce the EU into pursuing its interests.

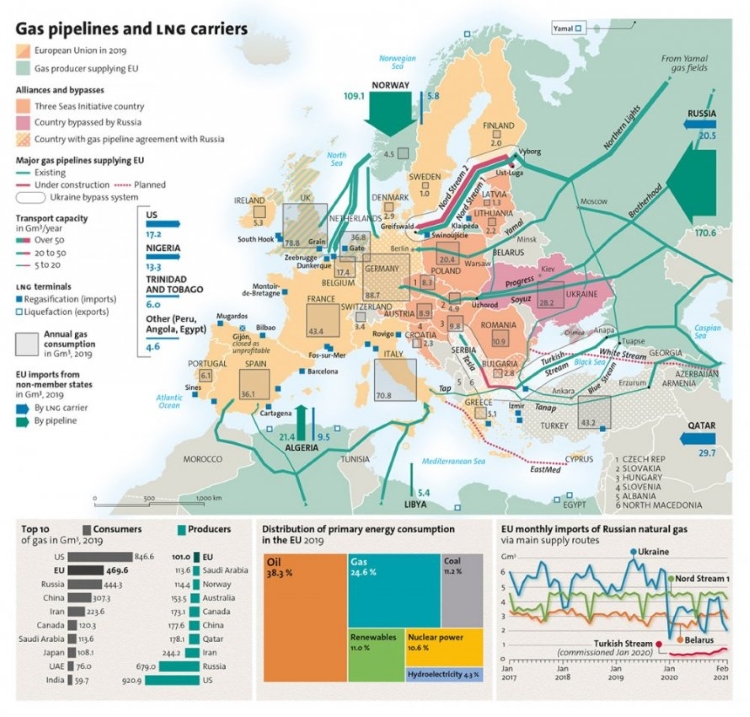

With this context, there is a search for diversification of the European Union with its gas suppliers, mainly seeking new alliances in the Middle East and North Africa, and the creation of new gas pipelines to meet the demand of its population and companies. It is the search for the so-called “energy sovereignty” and one of the pillars of “strategic sovereignty” searching for the EU.

Why the European Union is so dependent on Russian gas for energy

Russia is the European Union’s largest supplier of natural gas, with several gas pipelines across Europe.

The great dependence of the EU with the use of gas is due to its use in the production of electric energy and heating, being about 25% of gross energy use, mainly in Germany, Italy and the United Kingdom. Russia has a majority stake of one third of natural gas imports.

The Russian hegemony allows an advantage for the country, since it has control over a considerable part of the energy supply to the European Union. This restricts the EU’s freedom to pursue its interests, interests which may go against Russia’s objectives but which cannot be realised for fear of losing the main energy raw material.

And the Kremlin has no problems in recall this insecurity and dependence, threatening, where appropriate, to close the European supply valves.

The EU’s quest for energy sovereignty

Since 2010 there has been a search for security plans, in case there is a cut in Russian supply, through a strengthening of European internal energy integration, increasing solidarity relations between States-membership, and external renegotiation of the Intergovernmental Agreements (Igas) to secure European trade sovereignty contracts in energy supplies with developing countries.

“Solidarity means that, in difficult times, we can send gas from one country to another to ensure full gas supply to families, to important social service providers such as hospitals and to some gas stations to avoid power cuts”

Relator do Parlamento e Conselho, Jerzy Buzek (PPE, polonium), UE

In addition, the EU has the objective of diversifying supply, seeking new relations with actors from the Middle East and the Caspian regions, to end dependency and energy islands in Central and Eastern Europe, which in turn depend on Russian gas.

For this, the Union plans to build new pipelines, such as the Turkey-Greece-Italy Interconnector (ITGI), the Nabucco and progress of the Trans-Anatolian Natural Gas Pipeline (TANAP) and South Stream. In addition, the EU plans to increase its relations with the US, Australia and East Africa for the import of Liquid Natural Gas (LNG) via ships through ports on the European coast.

This action plan seeks not only greater economic and industrial development, but the security of energy sovereignty of the European Union and its strategic autonomy in the geopolitical scenario.

The “Nord Stream” controversy or the European North Pipeline

The construction of new pipelines is the main horizon of independence for the EU, but there are other projects with Russia that are still questionable and under discussion, such as the Nord Stream between Russia and Germany.

Nord Stream is an existing pipeline but is under analysis for its increase with more pipelines, the Nord Stream-2. It passes through the Baltic Sea and is a direct link between Russia and Germany, not passing through any other country’s territory.

Currently it has a supply of 55 billion m3 annually, and can double its capacity and reach 110 billion m3 annually with the Nord Stream-2.

However, there are many European countries and other political actors (such as the United States) who see a project of this magnitude as a further advantage for Russia and deepening the economic dependence of the European Union.

Ukraine and Poland are the main criticisms of the project, since Ukraine goes through tense relations on the borders with Russia, but also because both are transit countries for Russian gas pipelines to Germany. The Nord Stream project goes against your interests as it would directly link the two countries and lose the taxes charged for the ticket.

In the Authorization of Fiscal Act of the year 2020 of the United States, sanctions on the construction of the pipelines were carried out, what delayed its implementation and the endorsement for its construction. However, in May 2021, Joe Biden’s government lowered these sanctions after an agreement with former Chancellor Angela Merkel that contained a German use limit for Russian natural gas until 2024, a commitment in support of Ukraine for investment ($50 million) in sustainable energy as compensation for its greater vulnerability to the loss of gas transit taxes.

Since then there has been a great advance in the construction of the project between July and September 2021, awaiting approval from the European Union.

EU relations with Germany still changing after the departure of Angela Merkel and the possession of Olaf Scholz. Polish Prime Minister Mateusz Morawiecki hopes that the new German manager will rethink the agreements with Russia:

“I will call on Chancellor Scholz not to give in to pressure from Russia and not to allow Nord Stream 2 to be used as an instrument for blackmail against Ukraine, an instrument for blackmail against Poland, an instrument for blackmail against the European Union,”

Mateusz Morawiecki, December 9 2021

Alternatives outside Russia for gas imports into the European Union

The main alternatives to Russia for the diversification of gas imports from the European Union are Azerbaijan, Georgia, Turkey, Cyprus, Israel, Iraq, Libya and Algeria.

- The Azerbaijan is the country with the greatest potential to replace the Russian role in the supply of gas, already having a history of participation in new projects with the EU such as the Azeri-Chirag-Deepwater Guneshli and Shah Deniz gas condensation project. He is already involved in the investments of the Baku-Tbilisi-Ceyhan (BTC) and Baku-Tbilisi-Erzurum (BTE) gas pipelines.

- They have already agreed, in 2014, to supply gas to the Trans-Adriatic Pipeline (TAP) that will pass through Turkey to the European Union. Furthermore, it is the country of origin of the Trans-Anatolian Natural Gas Pipeline (TANAP).

- The TANAP is the main project involving Georgia, as it leaves Azerbaijan and passes through the country to Europe. Also called South Stream, the TANAP routes the Caspian Sea to southern Europe in Italy, connecting the Caucasus Southern Pipeline with TAP.

- Turkey is one of the transit countries of the pipelines, which guarantees it a high gain of geopolitical power in this agreement. If the South Stream plan does not materialise, there are plans to build a Turkish gas pipeline linking with Europe. This is a key country for the diversification of Europe, as Azerbaijan and Russia have trade relations, while Turkish and European Union interests are fully aligned as it benefits both.

- Cyprus and Israel recently discovered natural gas reserves, gaining supply and export potential for the EU. However, there are two obstacles to these agreements: to convince Cyprus to allow Israeli gas pipelines to pass through the Economic Exclusiveness area, which would allow the EU to exert even greater influence over the countries of the Middle East (mainly Turkey).

- Iran, Iraq, and Kurdistan have oil and gas reserves with export potential, but the countries’ political conflicts complicate the conclusion of agreements. The rapprochement between the Kurdistan Government in Iraq and Turkey is an advance to realise the gas pipelines in northern Iraq.

- Algeria was already the second largest supplier of natural gas in the European Union, just behind Russia. It supplied more than 25 billion. m3 in pipelines and 13.5 bi. m3 per LNG.The agreements with the EU are a search for strengthening the internal market, mainly in the utility, desalination and chemical industrial sectors. These particular and internal interests limit European action.

- Libya, like Algeria, already has gas export relations via Greenstream Pipeline to Italy. Unlike its neighbour, Libya is a much more stable agreement as its domestic market is not in great development and still depends on exports by pipelines or LNG.

In addition to these countries, Brussels has gas supplies from Norway, Nigeria, Qatar and the United States in the form of LNG. There is the investment, which relies mainly on US support, for the construction of more ports on the European coast so that dependency with Russia is extinguished.

List of projects and pipelines in countries and imports of LNG

- Trans Adriatic Pipeline (TAP)

Designed in 2003 and built in 2016, TAP started operating in 2020 and connects Azerbaijan with Italy. It passes through the Caspian Sea region through Greece and Albania, originating in the Shah Deniz field and transiting through the South Caucasus and TANAP pipelines to Europe. It is part of the so-called “Project of Common Interest” of the European Union institutions in search of energy security.

- Trans-Anatolian Natural Gas Pipeline (TANAP)

Located mainly in Turkey, TANAP delivers the South Pipeline Corridor (South Stream Pipelines) and connects Caucasus South with TAP. It has 1841 km, was designed in 2015 and opened in 2018. It allows gas exports from Azerbaijan to Europe and also strengthens Turkey’s role as a leading regional player in the energy field.

- Interconnector Turkey-Greece-Italy (ITGI)

It is a project to extend the existing gas pipeline between Turkey and Greece in 2007 with the construction of the link between Greece and Italy. Its implementation, however, does not have a defined deadline, since it competes with the supply of TAP and the gas pipeline between Greece and Bulgaria. This project has diplomatic and commercial implications that are still under discussion.

- Nabucco Pipeline

Also known as the Turkey-Austria gas pipeline, it aimed to diversify routes and gas receiving poles across Europe. With the support of several Member States and the US, it was a way to rival the contract between Italy and Russia (Gazprom-Eni South Stream project) and decrease the relationship with the country. The main supplier would be Iraq, with potential additions from Azerbaijan, Turkmenistan and Egypt. However, after the construction of TANAP, the project was aborted in 2013 and shelved.

- LNG receiving ports in the European Union

With the import receipt of liquid natural gas, the European receiving ports must go through the process of gasification of the liquid, for transport and internal use. The condensation of the gas is done so that the transport of areas that do not have a pipeline connection is facilitated, besides having several advantages:

- Guaranteed reduction in emission levels and total exemption of contaminants after burning;

- Has uniform burning, with great efficiency and quality in the combustion process;

- Lower cost compared to other liquid fuels on the market, as diesel, alcohol, gasoline and others;

The countries that supply LNG to the European Union are USA, Nigeria, Norway, Russia, Trinidad and Tobago, Peru, Angola and Egypt.

Ports are located in several coastal cities of countries such as Portugal, Spain, France, Italy, Belgium, Germany, Greece, Poland, Lithuania and Bulgaria.

[…] as Russia is currently a major exporter of natural gas, if other countries and regions have access to clean and unlimited energy via nuclear fusion, they […]

[…] there is a limited EU action since they also have dependency ties with Russia, failing to advance without affecting the Russian security interest zone. […]

[…] greater independence and economic growth for the country. For Russia, with the recent negation of Nord-Stream 2 in Germany, this project will allow a strengthening of economic relations with the neighbouring countries of […]

[…] with the private sector and even with the company of billionaire Elon Musk, since the pipeline Nord Stream-2 coming from Russia is with suspended […]

[…] 2007 the Union imported 82% of its oil and 57% of its natural gas, being the world leader in energy imports. Russia, Canada and Australia are the EU’s main suppliers. Even with new policies, in 2015 they […]

[…] European Union Commission released a new billion-dollar energy sovereignty project to decrease its dependence on natural gas and Russian oil and transition to greater use of renewable energy […]

[…] the global energy matrix of fossil fuels for renewable energy sources, oil-exporting countries and natural gas will lose economic power and geopolitical influence. At the same time, energy-intensive countries […]

[…] strategic autonomy of the EU and organized a meeting between V4 to discuss the cancellation of Nord Stream-2 and the situation with Belarus and Ukraine. […]