- The International Community has found itself over-reliant on China, especially after noting its vulnerabilities during COVID-19;

- Many countries and companies are looking for alternatives to China to avoid geopolitical dependency and rising labor costs in Beijing;

- Vietnam has been a great alternative for companies seeking to diversify and reduce their production costs.

The search for diversification of commercial partners has grown in many countries, driven largely by the current situation of war in Ukraine and the escalation of tensions between China and Taiwan. It is the so-called “China +1” policy where there is a diversification/duplication of production lines beyond China.

In this scenario, Vietnam has been widely used by the global industry as an alternative to China, allowing the diversification of its production lines. Its strategic location also makes Hanoi an attractive alternative for many companies.

Vietnam is already one of the great centers of industrial production in the world

Vietnam is already one of the great centers of industrial production for several reasons. Above all, the country has a young and relatively cheap workforce, even when compared to China, which has been a huge attraction for companies looking to reduce their production costs.

In addition, the Vietnamese government has implemented policies aimed at attracting foreign investment, including reducing taxes and simplifying regulations for companies.

Another important factor is the aforementioned geographic location of the country. Hanoi is situated in a strategic position in Southeast Asia, between China and the rest of Asia, making it a natural trading hub for the region.

Furthermore, the country has easy access to global markets, through its important seaports such as Ho Chi Minh and Hai Phong, as well as a network of highways and railways that facilitate the transport of products.

The country has also benefited from its participation in international trade agreements, such as the Trans-Pacific Economic Cooperation Agreement (TPP) and the free trade agreement with the European Union. These agreements have reduced trade barriers for Vietnamese products, increasing their competitiveness in the global market.

Why companies and countries see Vietnam as an alternative to China on “global value lines”

One of the main reasons Vietnam is being considered as an alternative is the geopolitical risk associated with China, including its tensions with Taiwan and the ongoing Chinese trade war with the United States and other countries.

Another reason is the international need to diversify its supply chains and reduce over-reliance on China, especially after the Covid-19 pandemic has exposed vulnerabilities and bottlenecks in the global supply chain. Diversification is also important to reduce the impact of exchange rate fluctuations and trade tariffs.

In addition, many companies are looking for alternatives to China to avoid the rising labor costs that are natural when a country becomes richer like China.

Vietnam, on the other hand, offers cheaper labor and an increasingly robust infrastructure, with continuous investments in ports, airports, roads and railways.

Companies are now changing the way they produce and source materials. Before, they focused on “just in time”, which is production according to demand, with very little inventory.

Currently, companies are more focused on “just in case”, creating a stock of products, in case something unexpected happens, to ensure that production does not stop.

It’s like they’re creating a plan B to make sure everything keeps working even in difficult situations. This change is a way to be more prepared and resistant to unforeseen events, even if it may cost a little more.

That’s why the “fashionable” phrase in world logistics today is “China + 1.” As we said, it is not replacing China completely in the value lines, but having an alternative supplier as a “plan B” in case something happens to China, whether due to geopolitical problems or Beijing’s national policies.

This trend is important for Vietnam because by pursuing backup supply options and resilience strategies, companies can bring more investment, jobs and economic growth to Vietnam.

Why Vietnam Can’t Fully Replace China as the World’s Factory

Although Vietnam has become an important center of global industrial production, there are some factors that prevent it from completely replacing China. Some reasons include:

- Limited Production Capacity: Vietnam has limited production capacity compared to China. Although Vietnam has attracted a lot of foreign investment in recent years, it is still a less developed country than Beijing and its production capacity cannot compete with that of China.

- Insufficient infrastructure: Vietnam’s infrastructure, including ports, roads and electricity, still needs to be improved to meet the demands of large-scale industrial production. This limits Vietnam’s ability to compete with China in terms of production.

- Lack of supplier diversity: Many important suppliers are still concentrated in China, which means that the global supply chain is still very dependent on the country. Although Vietnam has attracted a lot of foreign investment, it has yet to develop a diverse supplier network.

- Rising labor costs: As Vietnam becomes increasingly industrialized, labor costs are increasing, which may affect its competitiveness against other developing countries with even lower wages.

- Competition from other countries: Other countries such as India, Indonesia and Mexico are also emerging as alternatives to China. to measure

As more countries compete to attract foreign investment, there may be a dispersion of investment and a reduction in the concentration of production in China and Vietnam.

So, the trend of shifting production to Vietnam is likely to continue, however, Vietnam’s infrastructure still has some limitations and the country faces other challenges such as corruption and a lack of skilled labor.

Other countries being used to diversify production and supply chains beyond China

In addition to Vietnam, several countries have emerged as attractive options for companies pursuing the “China + 1” doctrine, including India, Indonesia, Mexico, some African countries and Romania.

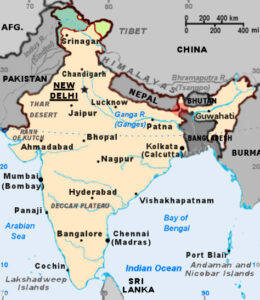

- India is one of the countries that has been considered as an alternative destination for industrial production. With a population of over 1.3 billion people and a young and growing workforce, the country offers great domestic market potential and a business-friendly environment. In addition to a strong base in information technology and investing in improving infrastructure to attract foreign investment.

- Indonesia has also attracted large-scale foreign investment. With its strategic location and large population, the country also offers a base for large-scale production, especially in sectors such as textiles and automotive. The Indonesian government has sought to attract foreign investment by offering tax breaks and simplifying regulations.

- Mexico is close to the United States, its internal market is growing and its strong industrial base make it an attractive destination. The Mexican government has taken steps to attract foreign investment, including implementing structural reforms and reducing bureaucracy.

- Ethiopia and Kenya have attracted foreign investment in the textile industry, due to the availability of cheap labor and strategic location for export to Europe and the United States.

Another important factor is the phenomenon of “reshoring” and “nearshoring” that has gained strength in recent years, with companies transferring production back to their countries of origin or to nearby countries. This is driven by factors such as the need to reduce transportation costs, the desire for greater control over quality and the protection of intellectual property.

In the case of “nearshoring”, Mexico due to its proximity to the US and countries in the Balkans due to its proximity to Western Europe would benefit the most.

Why moving factories and supply chains from China to Vietnam matters

In International Relations, the dispute for being a large-scale industrial production center is part of the geopolitical field. By losing space to emerging countries like Vietnam, China has its influence and economic and political power diminished in the International Community.

With the departure or retraction of large companies from its territory, the Chinese economy could suffer a strong impact, which could affect vital sectors of the government, such as investment in weapons and hostile diplomacy towards the US and Europe.

Furthermore, China may have its access to technologies reduced, as large companies with cutting-edge technology will stop producing and investing in the country, eliminating their chances of copying such technologies, which is a historical practice in Beijing.

Vietnam’s alliance with the United States in the South China Sea is another important factor. This area is territorially disputed between China and other countries in the region, including Vietnam. The presence of the United States in the region offers Hanoi greater security compared to Beijing.

However, China is aware of this movement of the richest countries on the international board and is also diversifying its production lines to other countries.

As a precaution, Beijing has companies that also produce in other emerging countries, such as Vietnam and Indonesia. That way, if the country suffers from economic sanctions, companies will continue to produce abroad.

Finally, while Vietnam is one of the main alternatives to China as a destination for industrial production, there are a variety of countries being considered as viable options for diversifying production and supply chains. Each country has its own advantages and challenges, and Vietnam has enough advantages to lead part of this race.

[…] this context, “reshoring” (bringing production back to the country of origin) and “nearshoring” […]

[…] the region could also create an incentive for South Korea and Japan to move closer as they seek a balance of power in East Asia, especially on issues such as maritime security and territorial […]

[…] During the Cold War, the Soviet Union cultivated close ties with several Asian countries, including Vietnam, which received significant military and economic support from Russia during its conflict with the […]

[…] such as Vietnam, Thailand and Malaysia have attracted a large part of foreign investment flowing out of […]