- Divided between national and multilateral/regional, these institutions finance long-term projects to promote infrastructure around the world;

- In addition to improving global infrastructure by investing in strategic projects, these institutions will more often than not boost the global economy;

- In this way, development banks are crucial geopolitically, reflecting their influence in the formation of bilateral and multilateral partnerships.

Development banks have a crucial role in International Relations and geopolitics for several reasons, reflecting their influence in forming strategic partnerships, promoting sustainable development and economic stabilization.

These banks, by materializing their investments in strategic projects, not only inject resources into the global economy, but also tangibly transform the infrastructure and development landscape around the world.

What are development banks and how do they work?

Development banks are financial institutions that have a crucial role in supporting the economic and social development of a country or region. Its main mission is to provide long-term financing for projects that stimulate economic growth, promote infrastructure, reduce poverty and improve quality of life.

Classified between national and multilateral, these institutions not only provide funds but also direct global development through investments.

National development banks are financed by only one country and can finance infrastructure projects domestically or abroad.

Multilateral or regional development banks are financed by two or more countries with the aim of financing regional or worldwide infrastructure projects.

The main characteristics of investments by development banks are:

- Provision of Financial Resources: Development banks raise funds through various sources such as loans, bond issuance, equity and contributions from member countries. These resources are then used to finance strategic projects such as hydroelectric railways.

- Long-Term Loans: A distinctive feature of development banks is offering long-term loans, often with terms that can extend over several decades. This allows the benefiting projects sufficient time to develop and generate sustainable returns.

- Favorable Interest Rates: Development banks often apply more favorable interest rates than those available in the conventional financial market. These more attractive conditions aim to facilitate access to financing for projects that could otherwise be economically challenging.

- Technical Assistance and Consultancy: In addition to financing, many development banks offer technical assistance and consultancy to help with the design, implementation and efficient management of projects. This includes expertise in areas such as urban planning, energy, agriculture, healthcare and education.

- Focus on Strategic Sectors: Development banks generally focus their efforts on strategic sectors such as transport infrastructure, energy, agriculture, education and health. These sectors are considered fundamental to stimulate economic development and improve the population’s quality of life.

- Participation in Multilateral Projects: Many development banks operate at a regional or global level, participating in multilateral initiatives. Examples include the World Bank, which operates in several countries, and the European Investment Bank (EIB), which finances projects in the European Union inside or outside the bloc.

- Risk and Sustainability Assessment: Before granting loans, development banks carry out rigorous analyzes to assess the economic, social and environmental viability of projects. Sustainability and positive impact on the community are key considerations.

- Social and Economic Return: Although development banks seek financial returns, the main focus is on social and economic returns. They seek to create an enabling environment for sustainable economic development by aligning their investments with long-term goals.

What are the 20 Biggest Development Banks in the World?

National Development Banks

- China Development Bank (CDB): The CDB is a Chinese state-owned financial institution, has assets of approximately $18.2 trillion, focused on financing projects such as infrastructure and economic development.

It is currently financing the “Beijing-Shanghai High-Speed Railway Development Project”, enhancing connectivity and boosting efficient transportation in China.

Furthermore, CDB is supporting the “National Electric Grid Modernization Project”, promoting a more efficient energy matrix.

- Kreditanstalt für Wiederaufbau (KfW Bankengruppe): KfW is a German bank, with assets of approximately $555 billion, with an emphasis on financing infrastructure projects, sustainability and promoting economic and social development.

KFW is involved in the “Energy Renewal in Urban Districts Project”, contributing to energy efficiency in German cities.

Furthermore, the bank finances the “Public Transport Network Expansion Project”, boosting sustainable mobility.

- International Bank for Reconstruction and Development (IBRD): is part of the World Bank Group, headquartered in the United States, with assets of approximately $332 billion, providing financing and technical assistance for development projects in middle-income and developing countries , covering several areas to reduce poverty and promote global economic growth.

IBRD, or IBRD in Portuguese, is involved in the project to increase preparedness against food insecurity and improve the resilience of food systems in Senegal.

The institution is also involved in a project to strengthen Tongo’s fiscal sustainability, as well as increase resilience to climate change and disasters in the country.

- Korea Development Bank (KDB): KDB is a South Korean financial institution, with assets of approximately $232 billion, with a primary focus on financing economic and industrial development projects, promoting the country’s sustainable growth.

The KDB is establishing a Forecasting and Early Warning and Early Action System in Sierra Leone to mitigate natural disasters in the country.

The bank is also financing capacity building for governments in Benin to scale up the “Local climate Adaptive Living Facility (LoCAL) initiative launched by Benin and the United Nations Capital Development Fund in 2014.

- International Development Association (IDA): is a part of the World Bank, based in the United States, with assets of approximately $226 billion, that provides financing and technical assistance to poorer countries, with an emphasis on reducing poverty and boosting economic development.

IDA is involved in projects such as decarbonization in Bosnia and Herzegovina, reducing pollution and, consequently, increasing sustainability and quality of life for the country’s citizens.

In the fiscal year ending June 30, 2023, IDA commitments totaled $34.2 billion, of which $7.3 billion was in grants to developing countries.

- Development Bank of Japan: The Development Bank of Japan is a Japanese financial institution, with assets of approximately $164 billion, dedicated to financing economic development projects, with an emphasis on strategic sectors.

The bank is involved in investments for renewable energy plants in the US.

Furthermore, the bank is also the first Asian bank to invest in a sustainable agriculture fund, also in the USA.

- Brazilian Development Bank: The National Bank for Economic and Social Development (BNDES), is a Brazilian state-owned financial institution, with assets of approximately $135 billion that aims to finance projects that promote economic and social development.

Among other projects, BNDES participated in the construction of the Tumarín hydroelectric plant, in Nicaragua.

Another example is the bank’s financing for the construction of the Moamba Major dam, in Mozambique.

- Bank Gospodarstwa Krajowego: BGK is a Polish financial institution, with assets of approximately $64 billion, that finances infrastructure projects, innovation and strategic investments.

BGK is involved in building social rental housing for low-income families in Poland.

Furthermore, the bank also invests in social companies and NGOs, so that new workplaces are created, boosting the country’s job market.

- State Corporation Bank for Development and Foreign Economic Affairs Vnesheconombank (VEB.RF): VEB.RF is a Russian financial institution, with assets of approximately $51 billion, with an emphasis on financing infrastructure projects, innovation and international economic cooperation.

It is supporting the “Trans-Siberian Railway Modernization Project”, enhancing rail connectivity in Russia.

Additionally, the bank is financing the “Nuclear Technology Development Project”, promoting innovation in the nuclear area.

- Industrial Development Bank of India Ltd. (IDBI Bank Ltd.): IDBI is an Indian bank, with assets of approximately $39 billion, that plays a significant role in the country’s industrial development, focusing primarily on financing infrastructure projects and loans for the industrial sector.

United with the World Bank, IDBI is investing in a project that aims to finance imported goods and services needed to develop small and medium industrial enterprises in India and improve the performance and effectiveness of companies serving this sector.

In addition, IDBI also finances the extension of technical and administrative support for the expansion of national industries.

Multilateral or Regional Development Banks

- World Bank: Headquartered in the United States, the World Bank, with assets of approximately $32 trillion and 189 members, is actually a collection of international financial institutions that provide financial and technical assistance to developing countries.

He is currently involved in the “Sustainable Agriculture Development Project” in Bangladesh and the “Water Supply and Sanitation Project” in Honduras.

Additionally, the World Bank is financing the “Inclusive Education Development Project” in Mozambique and the “Public Transport Network Development Project” in Ghana.

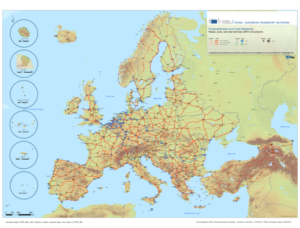

- European Investment Bank (EIB): is a government bank based in Luxembourg, with assets of approximately $619 billion and 27 members, specializing in financing projects that promote economic and sustainable development in European Union member countries and beyond, covering sectors such as infrastructure , innovation and environment.

The EIB has over decades financed Belgium’s education and infrastructure, such as the national railway, the port of Antwerp, clean water, renewable energy and digital connectivity.

Following the 2023 earthquake, the EIB also provided €400 million to support Türkiye’s efforts to rebuild the country’s infrastructure.

- Asian Development Bank: is an international financial institution based in the Philippines, with assets of approximately $271 billion and 68 members, which aims to reduce poverty, promote sustainable economic development and projects in diverse areas such as education, health, infrastructure and governance in Asia and Pacific region.

Among other projects, the bank has plans to initiate a Climate Resilient Urban Services Project in Vietnam so that the city of Tham Luong Ben Cat can more efficiently collect and treat wastewater and improve drainage in key areas.

Another example is the Urban Water Supply and Sanitation Project in Papua New Guinea.

- European Bank for Reconstruction and Development (EBRD): is a multilateral bank, headquartered in England, with assets of approximately $71 billion and 72 members, which seeks to promote economic development and the transition to market economies in countries in Central Europe, Eastern Europe and Central Asia, providing financing and support for projects that drive structural reforms and strengthen the private sector.

EBRD is involved in the “Road Modernization Project” in Georgia and the “Renewable Energy Development Project” in Kosovo.

Additionally, EBRD is financing the “Energy Storage Technology Development Project” in Ukraine and the “Information Technology Infrastructure Development Project” in Kazakhstan.

- African Development Bank (AfDB): is an African regional financial institution based in Côte D’Ivore, with assets of approximately $50 billion and 82 members, which seeks to promote sustainable economic development, reduce poverty and improve living conditions on the continent, through investments and financing in various sectors, such as infrastructure, education, health and social development.

The Bank embarked on a vast program to support the development of the industrial port activity area in Kribi, Cameroon, financing preliminary studies for the project to build a bridge over the Ntem River.

Additionally, it is working with the government of Cameroon on a large-scale program to open the Autonomous Port of Kribi (PAK).

- Asian Infrastructure Investment Bank (AIIB): is a multilateral financial institution based in China, with assets of approximately $40 billion and 109 members, created to finance infrastructure projects in Asia and other regions. Its objective is to promote sustainable development through investments in sectors such as transport, energy, water and sanitation.

One of AIIB’s recent projects, financing Uludağ Elektrik Dağitim A.Ş’s regulatory capex program. (UEDAŞ), to Increase access to electricity in the Uludağ region by upgrading, modernizing and expanding the electricity distribution network.

Another example is the financing of the Integrated Solid Waste Management Improvement Project in Bangladesh.

- Council of Europe Development Bank: is an international financial institution, headquartered in France. with assets of approximately $33 billion and 43 members, operating within the framework of the Council of Europe, focused on providing financial assistance for social and sustainable development projects, with an emphasis on areas such as social infrastructure, education, health and the environment, aiming to promote cohesion social and economic status among member countries.

The council will co-finance in 2024 the renovation of Lithuania’s public buildings to ensure energy efficiency and accessibility of public services to vulnerable groups, local communities and the general public.

The bank also co-financed the budgetary expenditure of the city of Malmö, Sweden, for the construction of new mandatory school buildings, as well as the modernization and renovation of existing ones throughout the city.

- Islamic Development Bank: is a multilateral financial institution, based in Saudi Arabia, with assets of approximately $32 billion and 57 members, which operates in accordance with the principles of Islamic law (Sharia). Its main focus is financing development projects in Islamic member countries, covering sectors such as infrastructure, health, education and socioeconomic development.

Through the bank, Türkiye carried out a Seismological Earthquake Survey in Pakistan, transferring technology. The project aims to improve Pakistan’s ability to detect and monitor earthquakes and assess their risks.

The bank also financed the Solar Energy for Rural Development project in Mali. With the collaboration of Morocco, the project aims to increase Mali’s capacity for rural electrification by establishing a model that provides affordable and reliable electricity to rural communities through solar energy.

- Latin American Development Bank (CAF): CAF is a multilateral financial institution, based in Venezuela, with assets of approximately $46 billion and 19 members, that aims to promote sustainable development in Latin America by providing financing and technical assistance for projects such as infrastructure, energy, environment and social development.

In Latin America, CAF finances the “Port Infrastructure Development Project” in Peru and the “Railway Expansion Project” in Colombia.

Additionally, CAF is involved in the “Technology Parks Development Project” in Mexico and the “Solar Energy Systems Development Project” in Argentina.

- International Finance Corporation (IFC): IFC is a private international financial institution, part of the World Bank Group, based in the United States, with assets of approximately 38 billion and 186 members, focused on promoting private sector investment in developing countries. IFC provides financing and advisory services for private projects in sectors such as infrastructure, health, education and technology, aiming to stimulate sustainable economic development and poverty reduction.

IFC is financing the “Solar Energy Project in Minas Gerais” in Brazil and the “Financial Technology Development Project” in Sub-Saharan Africa.

Furthermore, IFC is involved in the “Sustainable Industrial Park Development Project” in India and the “Communication Network Modernization Project” in Türkiye.

What are the possible impacts of Development Banks on Geopolitics?

Development banks play a vital role in global geopolitics due to their ability to promote economic growth, financial stability, bilateral partnerships and influence international relations.

It is also possible to find criticism of the actions of development banks. One of the challenges associated with development banks is the risk of excessive debt on the part of countries receiving investment.

A good example of this were some infrastructure projects financed by Chinese development banks as part of the Belt & Road project that ended up putting the countries receiving the loan into massive debt.

One of the most famous cases was a port built in Sri Lanka with Chinese loans. This project left Colombo heavily in debt and unable to repay Beijing for its loans. The result was a serious financial crisis in the country and the transfer of control of the port to the Chinese government for 99 years.

The selective distribution of financing by some development banks may also reflect specific geopolitical interests. This can create inequalities and tensions between countries, raising concerns about fairness in resource allocation and the potential for geopolitical influence.

Despite this, by financing infrastructure and social projects, these institutions invariably contribute to sustainable development, reducing socioeconomic disparities and strengthening diplomatic ties.

In general, development banks play a fundamental role in financing and building the national, regional and global infrastructure that is essential to creating and leveraging economic growth and generating prosperity at a global level.

However, like any national or multilateral institution, they are also used as geopolitical tools to shape international relations between different countries.

[…] recognizing the importance of protecting the fragile Arctic ecosystem and promoting sustainable economic development in the […]