- The Paris Club and its permanent members are important in resolving developing countries sovereign debts;

- The organization also has temporary members and observers who influence negotiations;

- Despite its importance, the group receives criticism of its functioning and some questions about the organization’s international relevance.

The Paris Club, an informal international entity that plays an important role in the global economic system. However, in recent years, China‘s emergence as the world’s largest bilateral creditor has impacted developing countries’ pursuit of Paris Club assistance.

Despite this, its recent performance in financial crises, as in the case of Sri Lanka and Ghana, demonstrates its relevance in promoting financial stability, highlighting its crucial role in the international economic scenario.

What is the Club de Paris or Paris Club and who are its current permanent members?

The Paris Club, also known as the Paris Club, is an informal international entity that plays a fundamental role in resolving issues related to the external debt of developing countries.

Founded in 1956, the Paris Club is made up of creditor governments from various nations, mainly developed and rich countries, who work together to find coordinated and sustainable solutions to the payment difficulties faced by debtor countries.

The main objective is to negotiate sovereign debt restructurings, offering more favorable terms and extended deadlines, in order to ease the debt burden on developing nations.

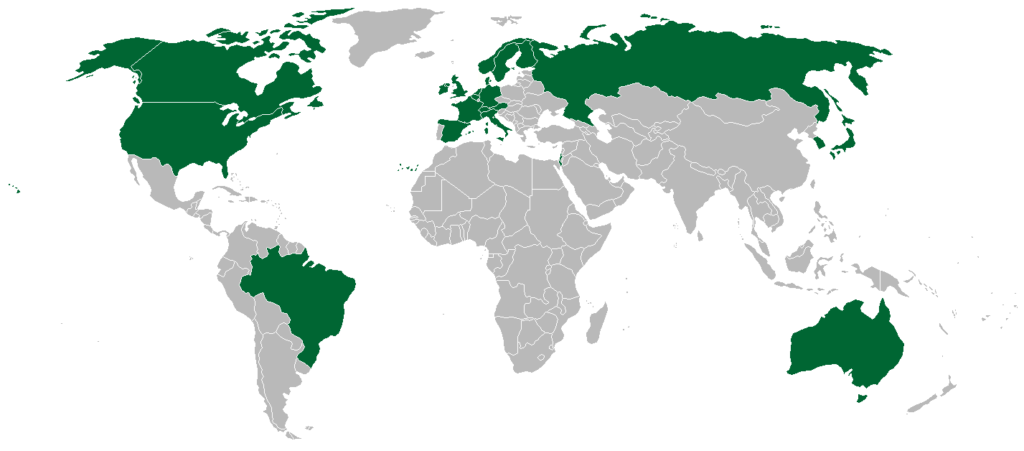

The organization’s membership may vary over time as new creditors join and others leave. However, the list of permanent members in 2023 includes 22 countries.

They are: Australia, Austria, Belgium, Brazil, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Japan, “South” Korea, the Netherlands, Norway, Russia, Spain, Sweden, Switzerland, the United Kingdom and U.S.

These countries therefore play a crucial role in debt restructuring negotiations.

How does the participation of Ad Hoc members and observer members work?

The Paris Club also opens the door to the participation of other official creditors in its regular negotiation meetings and discussions known as “Tours d’Horizon”.

“Ad hoc participants” refer to additional creditors who are not permanent members of the Club, but who are invited to participate in specific negotiations or discussions. They are called “ad hoc” because their participation is temporary and specific to that particular situation.

However, this inclusion is subject to the approval of regular members of the club and the country in question. New entrants must adhere to fundamental principles and act ethically.

Among the countries that joined these negotiations, on a temporary basis, are:

- Abu Dhabi, Argentina, China, Czech Republic, India, Kuwait, Mexico, Morocco, New Zealand, Portugal, Saudi Arabia, South Africa (which became a potential member on July 8, 2022), Trinidad and Tobago and Türkiye.

In the case of observer members, they play a role in negotiation meetings, but do not have direct participation in the negotiations themselves and are not signatories to the final agreement that formalizes the results of the negotiations.

There are three categories of observers:

- Representatives from international institutions, such as the IMF, World Bank, OECD, UNCTAD, European Commission, African Development Bank, Asian Development Bank, European Bank for Reconstruction and Development and Inter-American Development Bank.

- Representatives of permanent members, who have no claims involved in the debt negotiation, for example, creditors whose claims are covered by minimum provisions, or who are not creditors of the debtor country in question but wish to participate in the negotiation meetings.

- Representatives of countries that are not part of the organization, but that have claims against the debtor country in question. Your participation as an ad hoc observer is possible as long as the permanent members of the Club and the debtor country agree to your participation.

What are the 6 principles of the Paris Club and how do their negotiations work?

The informal organization operates based on six essential principles that guide its negotiations with debtor countries. Here are the principles and how negotiations work:

- Solidarity: All members of the Paris Club agree to act together in their relations with a debtor country and consider the impact of their individual claims on the claims of other members. This implies a coordinated approach to dealing with the debtor country’s debt.

- Consensus: Decisions at meetings are taken by consensus among participating creditor countries. This means everyone must agree before a decision is made, ensuring a collective bargaining process.

- Information Sharing: The Paris Club is an information sharing forum. Members regularly share information on the situation of debtor countries, using data from the IMF and World Bank, and exchange data on their own claims. Discussions are kept confidential to maintain confidentiality.

- Case by case: The group makes individual decisions, adapting its actions to the unique situation of each debtor country. This allows negotiations to be flexible and adapted to the specific needs of each nation.

- Conditionality: The Paris Club only negotiates debt restructurings with debtor countries that demonstrate the need for debt relief. These countries must provide accurate information about their economic and financial situation and must have implemented reforms or be committed to implementing them to restore your financial health. Additionally, they must have a track record of implementing reforms under the supervision of an IMF program.

- Comparability of treatment: A debtor country that signs an agreement with the group cannot accept less favorable terms of treatment of its debt than those agreed with the Paris Club of other creditors. This ensures that the terms of the agreement are fair and equitable to the debtor country.

These principles help guide the group’s negotiations and ensure that sovereign debt renegotiations are conducted fairly and effectively, taking into account the unique situation of each debtor country.

However, it is important to note that the organization, due to its discreet and confidential nature, does not usually publicly disclose the details of the negotiations it conducts. Therefore, information on sovereign debts renegotiated by the Paris Club is not widely available.

Some examples of debt renegotiation with the organization’s assistance include nations in Latin America, Africa and Asia. The specific details of these renegotiations are generally kept confidential. This is done to protect the confidentiality of the parties involved and allow negotiations to be conducted more effectively.

What are some of the criticisms regarding the Paris Club

The group, despite its importance in managing the sovereign debts of developing countries, has faced criticism over the years. Some of the main criticisms include:

- Lack of Transparency: the organization is known for conducting its negotiations in a confidential and confidential manner. This has led to criticism of a lack of transparency and accountability, as discussions are not accessible to the public or non-governmental organizations. Some argue that greater transparency could improve the quality of negotiations and allow external stakeholders to monitor the process.

- Focus on Creditors’ Interests: The group is made up of creditor governments, and its negotiations can be perceived as prioritizing the interests of creditors to the detriment of debtor countries. Some critics argue that this could lead to agreements that are not sufficiently favorable to countries in financial difficulties.

- Lack of Debtor Representation: Debtor countries are not part of Paris Club negotiations, which can be seen as a lack of direct representation of nations that are facing financial difficulties. This can lead to agreements that do not adequately reflect the needs and circumstances of debtor countries.

- Social and Economic Impact: Some critics argue that the terms of debt restructuring agreements can impose significant social and economic burdens on debtor countries. This may include austerity measures that negatively affect the citizens of those countries.

- Lack of Flexibility: The Paris Club operates based on rigid principles, such as conditionality, which may not suit the unique circumstances of each debtor country. Some argue that a more flexible approach might be more appropriate.

- Effect on Future Credit: Some debtor countries have expressed concern that seeking debt relief through the Paris Club could negatively affect their ability to access international credit in the future.

It is important to mention that the organization has evolved over time in response to some of these criticisms, seeking greater flexibility and considering the needs of debtor countries.

However, criticism continues to be an important part of the debate surrounding sovereign debt negotiations and international financial management.

The global importance of the Paris Club

The organization, despite being an informal entity, plays an important role in managing the sovereign debts of developing countries.

According to information available on its official website, the Paris Club has a history of 478 agreements signed with 102 debtor countries since its foundation. The total amount of debt covered by these agreements is impressive, totaling US$614 billion, thus highlighting their considerable role in resolving international debt crises.

Despite the emergence of China as the largest bilateral creditor in the world – consequently reducing the search for developing countries for the Paris Club – the informal organization maintains its importance today.

An evident confirmation of this happened in February 2023, when Sri Lanka needed help and approached the Paris Club for a rescue of US$2.9 billion.

Another example was the organization’s participation as a facilitator in Ghana’s debt restructuring negotiations also in 2023, which is crucial to the approval and disbursement of the IMF loan, and, in turn, is fundamental to economic recovery.

that of Ghana in the midst of its financial crisis.

Finally, as global economic dynamics evolve, the role of the Paris Club continues to be crucial in promoting the financial stability of diverse countries with economic problems and supporting sustainable development around the world.

Be First to Comment